The facility will finance the development of approximately 30,000 sqm of new residential space in an area undergoing significant urban regeneration. The project is aligned with Kinnerton’s Article 8 sustainability KPIs under the EU SFDR framework.

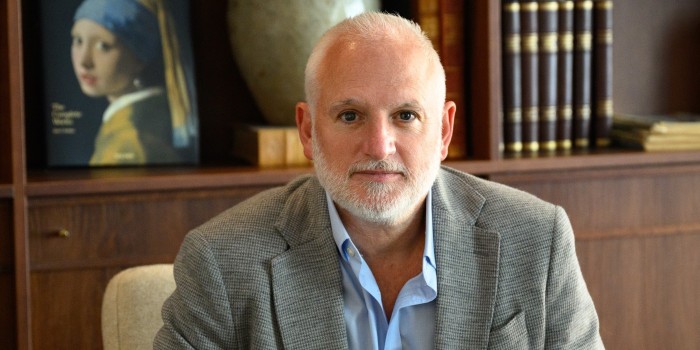

“This transaction marks an important milestone in our development credit strategy, underscoring both the scale of our platform and our commitment to financing high-quality, sustainable housing across the Nordics,” said Matthew Baker, Managing Partner at Kinnerton Capital.

The loan was structured as a sole senior lender solution, reflecting Kinnerton’s ability to execute large, complex transactions. At €91 million, it represents one of the largest residential development financings in the Nordic region this year.

Ulrik Emborg and Tobias Allingham led the transaction for Kinnerton. The firm extends its appreciation to Avenue Capital Group for their continued partnership and support.

This financing contributes to a strong first half of 2025, with significant volumes of residential development credit deployed across the Nordic region.

All Nordics

All Nordics

Sweden

Sweden

Denmark

Denmark

Finland

Finland

Norway

Norway